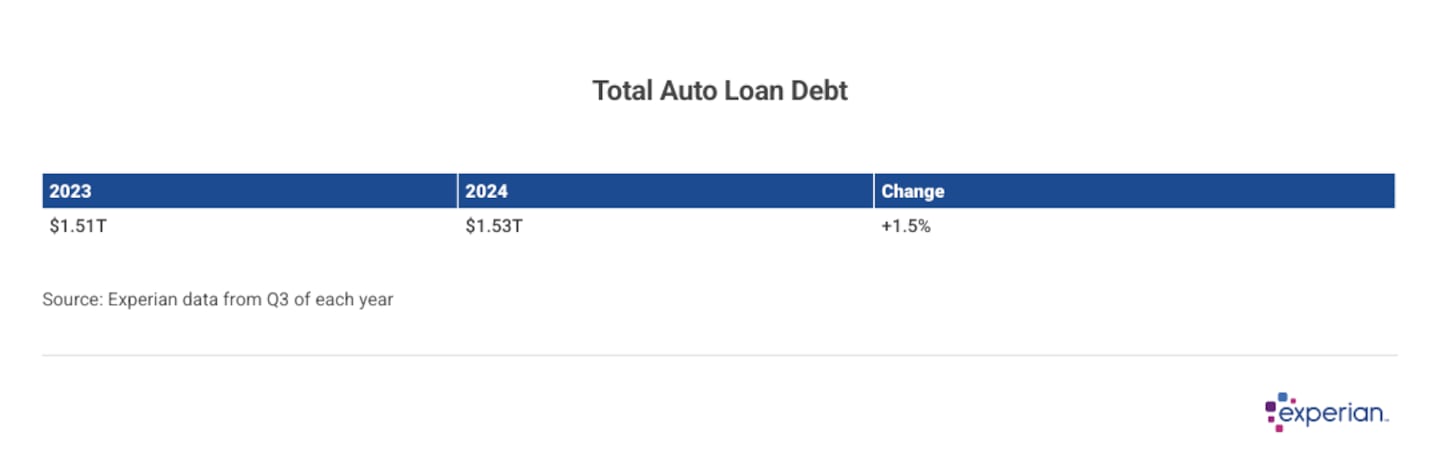

Just when activity began to normalize on the nation’s car dealer lots, tariff uncertainty threatens to increase auto prices for Americans in 2025. But for now, we’re taking a look at 2024 data, which shows car loan balances increased moderately last year.

The average auto loan balance held by consumers in the United States increased 2.1% to $24,297 as of the third quarter (Q3) of 2024, according to Experian data. This increase broadly impacted all U.S. regions and consumers of all ages and incomes intending to finance new and used vehicles. The average balance grew less than it did in 2023.

As part of its continuing coverage of consumer credit and debt, Experian looked at anonymized credit data to observe recent trends in auto financing and analyze how those trends may continue to affect car buyers in 2025.