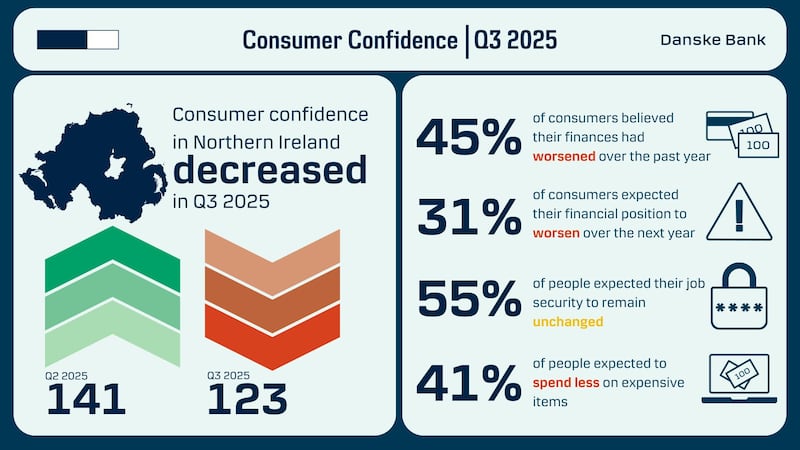

Consumer confidence in Northern Ireland declined in the third quarter of this year as people reported feeling less optimistic about their current and future finances, new analysis shows.

Danske Bank’s quarterly barometer, which collected data from 1,000 people across the north in September, found that 45% of respondents believed their finances has worsened over the past year, while nearly a third (31%) fear things will continue on a downwards trajectory into 2026.

And a separate study undertaken by the Credit Union movement in the north largely mirrored that sentiment.

It revealed that consumer confidence fell materially between August and November, reversing all of the improvement seen in the previous three months, which respondents blamed on the impact of stubbornly high inflation.

Danske Bank’s chief economist Conor Lambe said: “After holding up relatively well against the uncertain economic backdrop during the first half of this year, consumer confidence has now fallen back.

“In the third quarter, the impact of higher prices on household finances was again the most significant factor that dragged on confidence levels, as 41% of survey respondents identified it as the factor which had the largest negative impact on sentiment.

“When our survey was conducted, the UK inflation rate was 3.8%. Indeed over the four years since September 2021, the rate has only been at or below its 2% target on three occasions.”

He added: “In this survey, 12% of consumers pointed to global risks as the factor that most adversely impacted how they were feeling. This likely reflects the heightened levels of geopolitical and trade-related uncertainty experienced during 2025.

“Looking forward, with the impact of higher prices continuing to weigh heavily on sentiment, how quickly inflation returns to its target and the stability of the rate of price rises once it does, will be important watch-points for consumer confidence in the future.”

The Credit Union survey of 350 people found that 44% have less money to spend on Christmas 2025 than a year ago and consumers are likely to cut back on expenditure.

Economist Austin Hughes, who prepared the analysis, said: “Exceptionally negative commentary in the run-up to the November Budget, coupled with ongoing concerns around the cost-of-living, clearly weighed on the mood of Northern Ireland consumers of late.

“The tone of the sentiment survey suggests that Northern Ireland consumers may believe the worst is over, but they see no signs as yet of any marked improvement in economic and financial conditions.”