Source: site

- Debt collection calls in the U.S. more than doubled in early 2025, soaring to over 112,000 reports.

- Nearly half of complaints involved abusive or harassing tactics, raising consumer protection concerns.

- Georgia and its capital, Atlanta, top the nation for the highest per capita rates of debt collection calls.

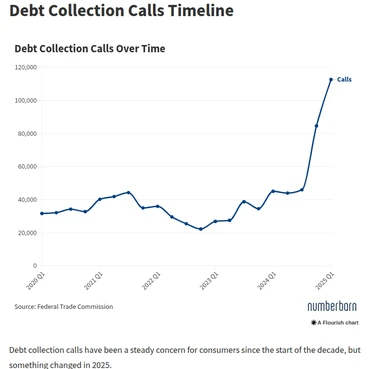

Americans are fielding a wave of debt collection calls this year, with new data revealing a dramatic spike in complaints and alarming trends in harassment reports.

According to an analysis of Federal Trade Commission (FTC) data by NumberBarn, a phone number management platform, consumers reported 112,583 debt collection calls in the first quarter of 2025 alone—a staggering 150% increase over the 44,999 complaints filed during the same period in 2024.

Perhaps even more troubling, nearly 47% of these calls—53,243 complaints—were flagged as abusive, threatening, or harassing, quadrupling from just over 13,000 reports the previous year. Experts warn this surge may reflect not only aggressive debt collection practices but also a rise in scam calls posing as legitimate collectors.

“Nationwide, the average debt per person is $61,660, which is a $970 year-over-year increase,” NumberBarn noted in its report.

Georgia leads the nation

Georgia has emerged as the epicenter of debt collection activity in 2025, recording 80.8 reports per 100,000 residents, the highest rate nationwide. Other states reporting high volumes of debt collection calls include Texas, Florida, and Delaware.

Among U.S. cities, Atlanta ranks first for per capita debt collection call reports, followed by Dallas, Miami, Houston, and Memphis. The clustering of high-report cities in the South underscores a regional trend where consumers are grappling with both legitimate debt collection calls and potential scams.

Younger adults most targeted

The data also shows that Americans aged 30 to 39 reported the highest volume of debt collection calls in 2025, suggesting that younger working-age adults are bearing the brunt of aggressive collection efforts amid rising personal debt burdens.

Meanwhile, California, Colorado, and Washington continue to report the highest average personal debt balances nationwide.

Know your rights

Experts urge consumers to know their rights under the Fair Debt Collection Practices Act (FDCPA), which prohibits debt collectors from using abusive, threatening, or harassing tactics. Any consumers experiencing harassment or suspecting a scam should report incidents to the FTC or seek legal advice.

Learn more about debt collection and debt management.