Advertisement

Source: site

- Earlier this month, Fair Isaac Corporation (FICO) announced the awarding of 10 new patents focused on Responsible AI, bias detection, and fraud prevention, and also held its Annual Meeting 2025 in Washington D.C. with key leadership presenting advances in predictive analytics.

- This patent expansion highlights FICO’s continued push for AI innovation and underscores its ongoing commitment to leadership in applied intelligence and transaction analytics across multiple sectors.

- We’ll examine how FICO’s advances in responsible AI, alongside new regulatory competition, could influence its future growth narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Fair Isaac Investment Narrative Recap

To be a FICO shareholder today, you need to believe in the company’s ability to defend its longstanding dominance in credit analytics, even as regulatory changes and increased competition pressure its core mortgage scoring business. The recent awarding of 10 new patents in AI and predictive analytics bolsters FICO’s technology edge but does not have a material impact on the most immediate catalyst, upcoming quarterly earnings, or the near-term risk of market share loss to VantageScore in mortgages.

Among this month’s news, FICO’s announcement of exclusive new patents in Responsible AI stands out. This deepens the company’s capabilities in bias detection and fraud prevention, supporting its broader objectives in transaction analytics innovation, areas that align closely with FICO’s growth narrative tied to expanding its software and platform segments.

In contrast, investors should also be aware of potential revenue concentration risks if competition accelerates from alternatives like VantageScore, especially as…

Read the full narrative on Fair Isaac (it’s free!)

Fair Isaac’s narrative projects $2.9 billion revenue and $1.1 billion earnings by 2028. This requires 14.3% yearly revenue growth and a $467.4 million earnings increase from $632.6 million today.

Uncover how Fair Isaac’s forecasts yield a $2017 fair value, a 28% upside to its current price.

Exploring Other Perspectives

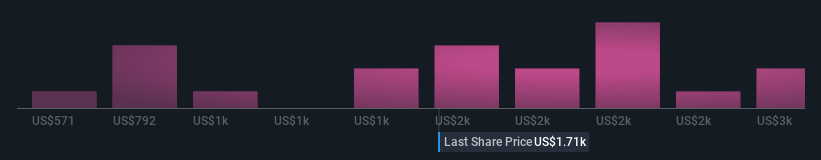

Seventeen fair value estimates from the Simply Wall St Community range from US$1,252 to US$2,627.67 per share, reflecting a wide variety of views. While some community members see considerable upside, the risk of FICO’s market share erosion due to regulatory change remains central to the company’s outlook, so reviewing multiple perspectives is important.

Explore 17 other fair value estimates on Fair Isaac – why the stock might be worth 20% less than the current price!

Build Your Own Fair Isaac Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

Looking For Alternative Opportunities?

The market won’t wait. These fast-moving stocks are hot now. Grab the list before they run:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com