Source: site

Foreclosures increased for the eighth consecutive month in October, as high costs continue to push activity toward pre-pandemic levels.

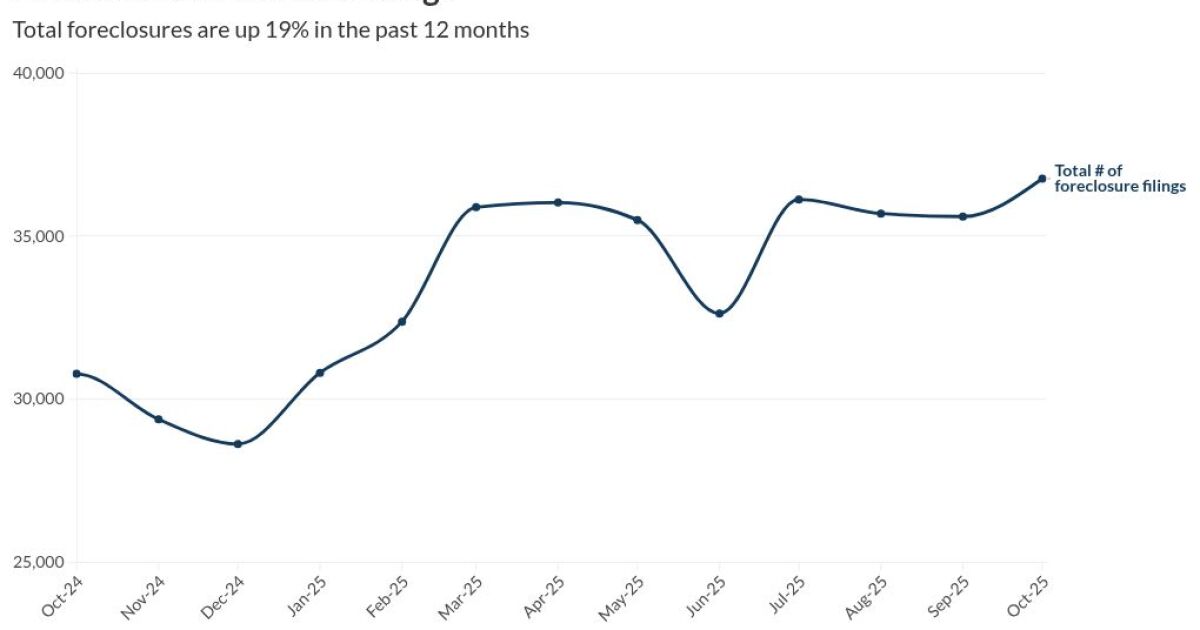

Total foreclosures in the United States eclipsed 36,000 last month, up 3% from September and 19% from the same time a year ago, according to ATTOM‘s latest foreclosure market report.

“Even with these increases, activity remains well below historic highs,” ATTOM CEO Rob Barber said in a press release Wednesday. “The current trend appears to reflect a gradual normalization in foreclosure volumes as market conditions adjust and some homeowners continue to navigate higher housing and borrowing costs.”

Foreclosure processes began on 25,129 homes last month, a 6% increase from September and a 20% increase from October of last year.

Repossessions through completed foreclosures also rose by 2% month over month and 32% year over year to 3,872 in October.

On a quarterly basis, more than 100,000 properties had a foreclosure filed from July through September, up less than a percent. If the fourth quarter maintains the pace October set, it will see the most foreclosures of any quarter this year.

Foreclosure activity in the United States has now increased for the eighth consecutive month, with October 2025 data confirming a 19% jump in foreclosure filings compared to a year ago and a 3% month-over-month climb. This rise signals a steady and ongoing trend, bringing the volume of foreclosures closer to pre-pandemic levels, although still well below historic peaks.

Key Figures from October 2025

-

A total of 36,766 residential properties had foreclosure filings in October.

-

Foreclosure starts (the beginning of the process) rose 6% from September and were up 20% from October 2024, reaching 25,129 new filings.

-

Completed foreclosures (REO repossessions) increased by 2% month-over-month and by 32% year-over-year to 3,872.

Leading States and Metro Areas

-

Florida, Texas, and California had the highest raw numbers of foreclosure starts in October.

-

Florida (one in every 1,829 households), South Carolina, Illinois, Delaware, and Nevada saw the highest foreclosure rates nationally.

-

Major cities with high rates included Tampa, Jacksonville, Orlando, Riverside, and Cleveland.

Contributing Factors

Several economic pressures are driving this extended surge:

-

Steep hikes in home insurance, utilities, property taxes, and maintenance costs, making it harder for homeowners to keep up with payments.

-

Higher borrowing costs from continued elevated mortgage interest rates are especially straining those with variable-rate loans.

-

Slower job creation and rising unemployment, leaving more households with reduced ability to pay their mortgages.

-

Diminished cash reserves for many homeowners after years of inflation and post-pandemic economic adjustments.

Market Perspective

Despite the recent increases, foreclosure activity remains below the peaks seen during the housing crisis of the late 2000s. Industry analysts view the current trend as a “normalization” of the market after years of pandemic-related protections and disruptions, though the data remains a warning sign as economic headwinds persist.