Quick analysis: Everything Dropped in November

Nov 2025 was one of those slower months resulting in a lot of red on the board for us when compared to the previous month’s numbers. But with the exception of TCPA, everything was actually up from last year. And in the case of TCPA, it is only down (nominally) from last year (and for the YTD) because Nov 2024 was so extraordinary with over 1000 TCPA plaintiffs in that month alone.

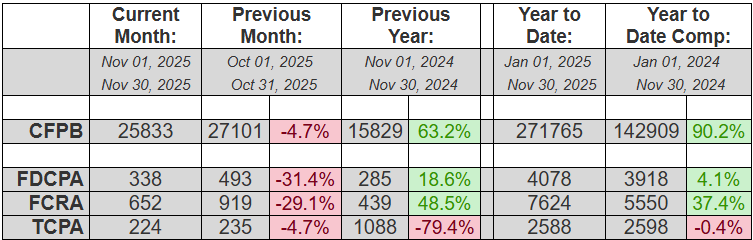

By the numbers, TCPA suits (-4.7%) were down in November along with FDCPA (-31.4%), FCRA (-29.1%), and CFPB complaints (-4.7%).

Year-to-date, everything except TCPA (-.4%) is still up, with FDCPA (+4.1), FCRA (+37.4%) and CFPB complaints (+90.2) all staying in positive territory for the year. Odds are, TCPA will rally for December to end the year in the black as well.

In other news, putative class actions represented 5.9% of FDCPA, 78.1%(!) of TCPA and 1.5% of FCRA lawsuits filed last month. TCPA class actions are still extraordinarily high, historically speaking. About 44% of all plaintiffs who filed suit last month had filed at least once before. And finally, South Florida attorney Gerald Lane (from The Law Offices of Jibrael S. Hindi) continued for a tenth straight month to represent both the most consumers in October (72) as well as YTD (736).

Complaint Statistics:

25833 consumers filed CFPB complaints, and about 972 consumers filed lawsuits under consumer statutes from Nov 01, 2025to Nov 30, 2025.

- 25833 CFPB Complaints

- 338 FDCPA, 20 Class Action (5.9%)

- 224 TCPA, 175 Class Action (78.1%)

- 652 FCRA, 10 Class Action (1.5%)

Litigation Summary (scroll down for CFPB data):

- Of those cases, there were about 972 unique plaintiffs (including multiple plaintiffs in one suit).

- Of those plaintiffs, about 429, or (44%), had sued under consumer statutes before.

- Combined, those plaintiffs have filed about 11002 lawsuits since 2001

- Actions were filed in 143 different US District Court branches.

- About 624 different collection firms and creditors were sued.

The top courts where lawsuits were filed:

- 87 Lawsuits: California Central District Court – Western Division – Los Angeles

- 86 Lawsuits: Georgia Northern District Court – Atlanta

- 57 Lawsuits: Illinois Northern District Court – Chicago

- 34 Lawsuits: Texas Southern District Court – Houston

- 32 Lawsuits: Florida Southern District Court – Miami

- 30 Lawsuits: California Central District Court – Southern Division – Santa Ana

- 30 Lawsuits: California Southern District Court – San Diego

- 30 Lawsuits: Florida Middle District Court – Tampa

- 25 Lawsuits: New York Eastern District Court – Brooklyn

- 24 Lawsuits: Florida Southern District Court – Fort Lauderdale

The most active consumer attorneys were:

- Representing 72 Consumers: GERALD DONALD LANE

- Representing 21 Consumers: OCTAVIO GOMEZ

- Representing 16 Consumers: GOR ANTONYAN

- Representing 16 Consumers: ZANE CHARLES HEDAYA

- Representing 15 Consumers: MITCHELL DAVID HANSEN

- Representing 15 Consumers: VICTOR ZABALETA

- Representing 13 Consumers: JONATHAN ALEXANDER HEEPS

- Representing 13 Consumers: YITZCHAK ZELMAN

- Representing 13 Consumers: SHELBY R SMITH

Statistics Year to Date:

12378 total lawsuits for 2025, including:

- 4078 FDCPA

- 7624 FCRA

- 2588 TCPA

Number of Unique Plaintiffs for 2025: 10448 (including multiple plaintiffs in one suit)

The most active consumer attorneys of the year:

- Representing 736 Consumers: GERALD DONALD LANE

- Representing 235 Consumers: ANTHONY PARONICH

- Representing 239 Consumers: ZANE CHARLES HEDAYA

- Representing 202 Consumers: OCTAVIO GOMEZ

- Representing 179 Consumers: FAARIS KAMAL UDDIN

- Representing 125 Consumers: JONATHAN ALEXANDER HEEPS

- Representing 114 Consumers: DAVID J PHILIPPS

- Representing 112 Consumers: MARK A CAREY

——————————————————————————————————-

CFPB Complaint Statistics:

There were 25833 complaints filed against debt collectors from Nov 01, 2025 to Nov 30, 2025.

Total number of debt collectors complained about: 1110

The types of debt behind the complaints were:

- 15569 I do not know (60%)

- 4114 Other debt (16%)

- 3084 Credit card debt (12%)

- 911 Rental debt (4%)

- 799 Telecommunications debt (3%)

- 608 Medical debt (2%)

- 448 Auto debt (2%)

- 178 Payday loan debt (1%)

- 52 Federal student loan debt (0%)

- 47 Private student loan debt (0%)

- 23 Mortgage debt (0%)

Here is a breakdown of complaints:

- 9618 Attempts to collect debt not owed (37%)

- 7359 Took or threatened to take negative or legal action (28%)

- 4538 Written notification about debt (18%)

- 3042 False statements or representation (12%)

- 730 Communication tactics (3%)

- 357 Electronic communications (1%)

- 189 Threatened to contact someone or share information improperly (1%)

The top five subissues were:

- 6827 Threatened or suggested your credit would be damaged (26%)

- 5558 Debt is not yours (22%)

- 3294 Debt was result of identity theft (13%)

- 2916 Attempted to collect wrong amount (11%)

- 2192 Didnt receive enough information to verify debt (8%)

The top states complaints were filed from are:

- 4349 Complaints: TX

- 3168 Complaints: FL

- 2297 Complaints: CA

- 2098 Complaints: GA

- 1037 Complaints: NY

- 917 Complaints: IL

- 898 Complaints: NC

- 897 Complaints: PA

- 727 Complaints: AZ

- 715 Complaints: NJ

The status of the month’s complaints are as follows:

- 14701 Closed with explanation (57%)

- 7571 In progress (29%)

- 2996 Closed with non-monetary relief (12%)

- 531 Untimely response (2%)

- 34 Closed with monetary relief (0%)

This includes 25059 (97%) timely responses to complaints, and 774 (3%) untimely responses.