Source: site

LINCOLN, Neb. (KOLN) — Income and property taxes are vital to the functioning of the government, so improper payment of income tax — or more specifically, nonpayment — impacts every Nebraskan.

The Nebraska Association of Public Employees confirmed 11 people were laid off at the state this week, all of whom were responsible for collecting the millions owed in delinquent individual income taxes.

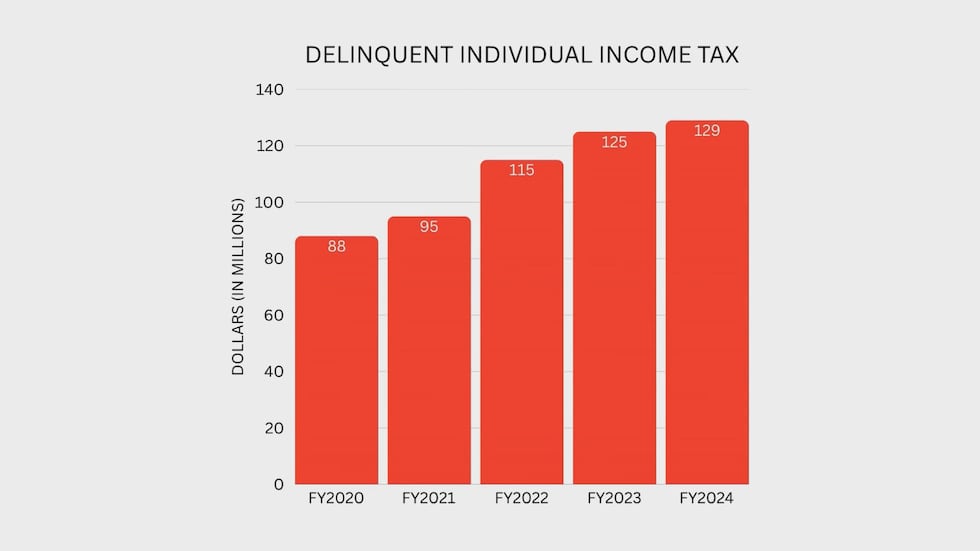

Many are well-behind in payment, with nearly $130 million dollars delinquent in the last fiscal year alone.

“Everybody should pay their fair share,” State Auditor Mike Foley told 10/11 on Tuesday. “No more, no less.”

An audit report released by Foley’s office in mid-April shows Nebraskans owed around $88 million in delinquent income tax in Fiscal Year 2020. By FY2024, that number was nearly $130 million. His office has flagged the increasing delinquency to the Nebraska Department of Revenue.

Foley emphasized it’s an issue of fairness, adding people shouldn’t get the idea they can avoid payment without repercussions.

However, Foley is skeptical now, after the layoffs.

“I was stunned when I saw that, because I thought they would be moving maybe in the opposite direction, maybe even bring in more people to look at this problem,” Foley said. “But instead they’re moving the other way.”

The Department of Revenue plans to streamline their operations, replacing these employees in part with automated technology. Tax Commissioner Jim Kamm wrote in a statement to 10/11 the move will “make the DOR more effective.”

“This was a very hard decision but one that is necessary for the department and the state to position the Nebraska Department of Revenue (DOR) strategically for long-term success in serving the taxpayers of the state in a fiscally responsible manner,” Kamm wrote. “The DOR is planning to streamline processes and increase the use technology going forward to enhance these operations. These changes will make the DOR more effective while increasing the efficient use of taxpayer dollars. I want to publicly thank the individuals impacted and acknowledge their hard work, dedication, and professionalism in serving our state.”

Justin Hubly, executive director of the Nebraska Association of Public Employees, expressed concerns, saying they have no proof the automation will be able to recoup all of the unpaid money.

“It seems that this is a penny-wise and pound-foolish adventure in laying 11 individual income tax agents off,” Hubly said. “If you save some money in the savings on salary and benefits, but you aren’t able to recoup north of $100 million worth of tax revenue, it doesn’t sound like you’ll actually save that money in the long run.”

Hubly added that laying off those tasked with getting revenue for the state will not solve the problem, and robots cannot replace all the tasks real, experienced humans can.

“I don’t think anybody in our union is anti-technology, but we need to make sure that it works first,” Hubly said. “And right now we don’t have any proof that there’s any way to collect this tax revenue using automation. And so I think it was premature.”

He isn’t aware of any certain upcoming layoffs but stated that the union has been told to expect further reductions-in-force.

Foley reiterated that they will be closely following the Department of Revenue’s numbers.

“And I don’t want to second guess them, because maybe they’re on the right track here, and I’m just not seeing it yet,” Foley said. “I get paid to be a skeptic, and we’re going to come back year after year and keep tracking this number until it starts going the right way — which is down.”

Click here to subscribe to our 10/11 NOW daily digest and breaking news alerts delivered straight to your email inbox.

Copyright 2025 KOLN. All rights reserved.