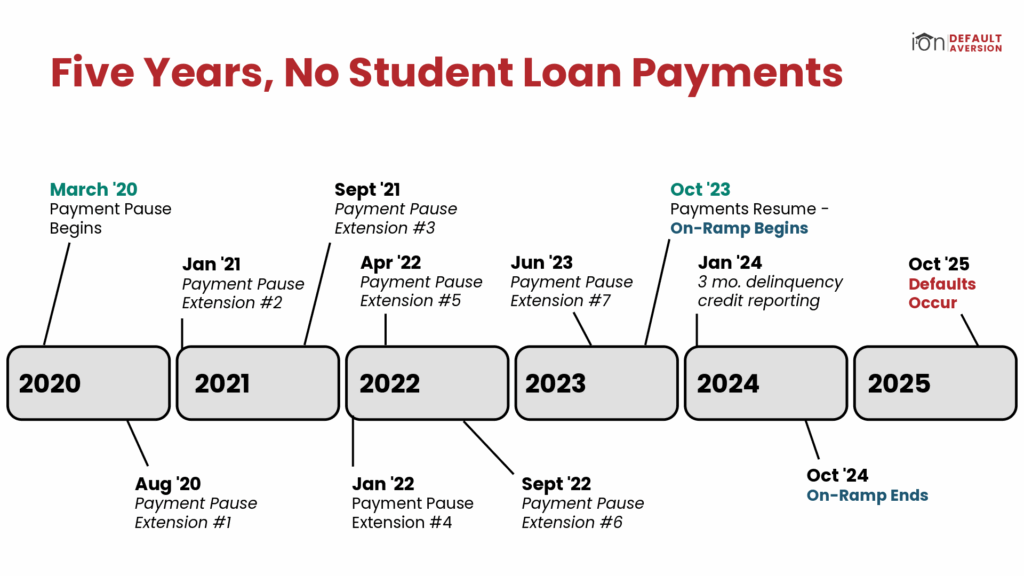

For the first time in five years, student loan borrowers are reaching the 270-day delinquent point, a status known as “technical default.” This is essentially the “final notice” for borrowers before they officially default on their loans.

The Significance of the 270-Day Delinquent Status

The 270-day mark is a crucial threshold in the world of default aversion. When a borrower hits this point, their loan is considered in “technical default.” The point occurred on June 28th, 270 days after October 1st, the date when the federal student loan repayment “on-ramp” period officially ended. This 12-month “on-ramp” was designed to ease borrowers back into repayment after nearly four years of pandemic-era pauses. The on-ramp shielded borrowers from the negative consequences of missed payments.

Technical default triggers the issuance of “final demand” letters to borrowers. These letters are a precursor to the loan officially defaulting, which will then directly contribute to an institution’s Cohort Default Rate (CDR). A student loan is considered in default typically after 360 days of non-payment.

The latest data from NSLDS showed 5.95 million borrowers in the 90-180 days delinquent status for FY2025 Q2. This figure is nearly 6.5 times higher than the 2019 figures before the pandemic pause began. This surge in delinquencies prompted the Department of Education to issue May’s Dear Colleague Letter, urging colleges to contact borrowers before June 30th in an attempt to maintain low CDRs and to retain eligibility for federal student assistance.

Why This Matters for Colleges

The rising number of borrowers crossing into technical default is a significant warning for several reasons.

- Impact on Cohort Default Rate (CDR): Every defaulted borrower directly increases an institution’s CDR. CDRs over 40% in a single year or over 30% for 3 years result in a loss of significant federal student aid programs.

- Reputational Risk: Financial Aid & Debt is a metric used on the Department of Education’s College Scorecard, which could negatively impact enrollment.

- Risk Sharing Possibilities: The College Cost Reduction Act and similar bills have proposed a “risk-sharing” framework that would hold colleges financially responsible for a portion of their graduates’ unpaid federal student loans.

What Can Be Done

The higher the delinquency, the more effort is required to bring a borrower back into good standing. Default aversion is an “ounce of prevention = a pound of cure” kind of situation. However, late-stage delinquencies are not hopeless. Contacting borrowers and providing them with the resources and guidance to avoid default will help lower your CDRs, but only if borrowers are contacted before they reach their 360-day delinquent point.

IonTuition can help safeguard your institution’s future and perform a CDR Health Check to let you know how high your CDR could be, but you need to act quickly. Contact ION today to get started.