Source: site

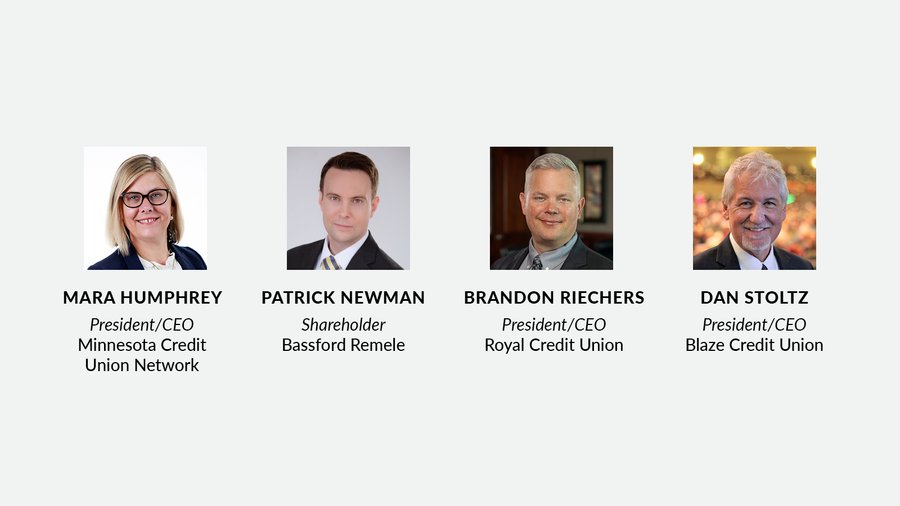

The Minneapolis/St. Paul Business Journal recently hosted an executive roundtable discussion about notable trends in the credit union industry, including uncertainty, transparency, culture and future sources of optimism. The panelists included Dan Stoltz, President/CEO of Blaze Credit Union, Mara Humphrey, President/CEO of the Minnesota Credit Union Network, Brandon Riechers, President/CEO of Royal Credit Union and Patrick Newman, a shareholder and attorney at Bassford Remele. The discussion was moderated by MSPBJ Publisher and Market President Whitney-Lehr Koening.

Whitney-Lehr Koening: Dan, what’s your take on the consumer mindset today, and how do you see it evolving?

Dan Stoltz: There’s tremendous volatility and uncertainty with consumers and businesses. The stock market is down one day and seeing great gains the next day. Unemployment numbers feel good, but they are creeping up. We’ve got a new president in office and words like “tariffs” are being used and businesses are starting to think about the negative impact to their business model. Since COVID, job security has gradually diminished. We’re seeing consumers have a lot more caution and “yellow lights” on things like big purchases and loans. There’s always uncertainty and volatility, but it just seems very extreme right now, and it’s working its way through all demographics. And yet, the consumer is keeping the economy moving. The biggest concern with this uncertainty continuing is what the impact will be in future years. Most of us are hopeful that we got it out of our system in 2025.

If there’s a positive in all this, it is that consumers are starting to save more and they are looking at more contingencies with all that uncertainty. More people are building up their cash reserves and emergency funding.

The last thing I’ll touch on is innovation. We’re all looking for different ways to do things better and faster, but it feels like we’re paring that back until we have more security in the future.

Koening: From now until the end of the year, what sort of trends can you see happening?

Stoltz: People are on the sidelines, really waiting to see where the interest rates go. Many people are uncertain about what’s going to happen with jobs as well, so I feel like this year is going to be that cautious yellow light through the whole year. You’re still seeing movement, but I feel that it’s still a cautious year for all of us.

Brandon Riechers: Cautious is how I would describe it, too, on both the consumer and business side. Long-term goals haven’t gone away, but many are sitting on the sidelines, waiting for some stability to return. Volatility has made people hesitant to invest, pausing construction and delaying buildouts. But we’re starting to see signs of settling, and as rates begin to decline toward the end of this year and into next, I think we’ll see more clarity and confidence heading into 2026.

At the same time, expectations haven’t shifted when it comes to experience. People still want a digital-first approach, but they also value human connection. What we’re seeing is a stronger emphasis on values-driven organizations – those that deliver meaningful human interaction without losing sight of the need for digital convenience.

Patrick Newman: This is anecdotal, but usually what you don’t want to see in terms of a healthy economy is practices like Bassford’s Consumer Finance group be busy. If we’re busy, that tends to be a bellwether for bumpy economic conditions. I suspect that when consumers find themselves with scarce resources to manage competing financial demands, at a certain point, a lawsuit becomes a viable option. And so does a bankruptcy filing. Using actual data, I can tell you that we’ve seen an increased litigation volume and I know that auto repossessions are up. That doesn’t necessarily square with how some sectors of the consumer public are reporting in, with some suggesting that they are making their way just fine in this economy. It’s a confusing time.

Stoltz: One thing, too, is I’ve always felt that credit unions perform well and grow quickly in more uncertain and difficult times. When times are good, people don’t look to switch their accounts. They’re very comfortable. But now, in these uncertain times, they’re looking for value, advice from trusted people, and things like rate opportunities.

Koening: We’re seeing a lot of consolidation and mergers in the marketplace — are credit unions experiencing similar trends to banks?

Mara Humphrey: Both sides are seeing similar trends of consolidation across the industry. It’s a value-driven decision of looking at how we can best serve our members, particularly to add in the high-tech piece and digital, that’s really driving that consolidation. When you look at how consumers do their banking or credit “unioning,” it looks very different now. Yes, they still go to the branch, but they’re also looking for a mobile app or other options. You used to want a branch within 15 miles of your house that you can drive by, and that is less important now.

Stoltz: Credit unions are fewer in number, but larger in our scope and overall size. The bigger scale gives these credit unions lots of opportunities to offer a better value proposition to consumers. For example, you can offer more in the way of technology when you combine two organizations, and provide high-tech and high-touch service to people

Humphrey: What’s driving the decision of a lot of credit unions towards if they are looking at a merger is that additional member value, because they can provide more of it by combining organizations and utilizing everything together.

Koening: When it comes to the merger, it helps high tech, but how does it affect high-touch?

Humphrey: I think it’s an important consideration for, how do we take what’s working really great at these two organizations and build a new one that is even better? It may not always be the same, but really looking at how you can build on the strengths of the combined organizations and then building in those nuances.

Riechers: High-touch can absolutely mean in-person or over-the-phone, but it also shows up in how we use data to personalize and tailor the experience. It’s not just about the channel – it’s about the quality of the interaction. When done right, data-driven personalization becomes a powerful extension of that high-touch approach. It can enhance the in-person or phone conversation, or even stand on its own as a meaningful, customized experience.

Koening: Brandon, from your perspective, what regulatory or economic forces are most influencing your credit union’s strategy?

Riechers: We start with the financial wellbeing of the member and financial health of the business – that’s what guides our strategy. From there, it’s about staying adaptable, especially as we navigate shifts from the Consumer Financial Protection Bureau and other regulatory changes. Even if we’re moving from heavily regulated to more deregulated environments, we’re focused on staying ahead of the curve. Ultimately, it comes down to being financially stable and serving as a pillar of strength – for our members and for the communities we’re part of.

Newman: The loss of a big federal regulator might outwardly look like it’s a positive. But in my view, what you really are doing is inviting the state-level regulators to step in and take over the regulatory process. So, if you are in multiple states, you might be dealing with more than one set of regulations laid over top of each other. In any event, regulated entities should expect to be dealing with state-level regulators with more regularity in the near term. Happily, in the Upper Midwest I’ve found that most state regulators are quite happy to talk to their licensees and actually will form relationships with them. And so the credit union industry being comprised of, essentially, members of the community, should embrace the notion that state regulators are members of that “community” as well, and really get to know their regulators and understand their expectations.

Humphrey: Going back to the analogy of yellow lights, that’s exactly what I think is happening right now in the regulatory environment. There’s just a lot of uncertainty happening right now, and it’s not a stop or a go ahead, it’s just everyone’s trying to figure out where things are landing. Our state regulators are doing a lot more examinations right now, and so it’s great that we have a great partnership with them.

Koening: Thinking about some of the “yellow lights” that were mentioned, how can these types of delays impact businesses?

Riechers: The business community is holding back on investments and hirings, which is where the bottleneck starts to happen. Too many yellow lights and everyone pulls back a little bit.

Stoltz: There is cause for concern that with leaner regulation, we as banks and credit unions will have to get exceptions and approvals. For example, mergers require regulatory approval, so, will they be slower in that response when we sometimes need answers more quickly? We’re worried that if mergers keep happening, will they get backlogged?

Riechers: With respect to the CFPB, the longer the industry stays disrupted, the greater the risk of each state acting independently. This could create inconsistencies across the country, which adds more uncertainty and expenses to everyone involved.

Koening: Patrick, in today’s climate — with rising litigation, regulatory scrutiny and operational pressures — how do you strike the right balance between protecting the institution legally and continuing to provide flexible, member-focused solutions?

Newman: I’ve heard it said before in the regulated entity space that it’s very helpful to think of your compliance and your revenue as being one and the same. But for this industry, I would actually say your compliance and your member engagement or service to your member has to be thought of the same way. But that has its limitations. Unfortunately, I have found that credit unions are, from time to time, susceptible to this unique phenomenon of “no good deed goes unpunished” by certain members. Whatever the issue is, for example, a member defaulting many times or having a history of problem loans, and despite best efforts by a credit union team who really is trying to do right and help the member, credit unions are sometimes thanked with a lawsuit or a Consumer Financial Protection Bureau, or attorney general, complaint. And so this part is really important for the credit union community to keep in mind: it’s not necessarily antagonistic to be member-centric and still be compliant. I actually think those constitute a single and coherent objective. But sometimes that dynamic creates a type of grieving process for credit unions where they don’t want to take adverse positions to their member, even where the member is a plaintiff in a lawsuit against the credit union. Finding a way to come to terms with the fact that preventing a loss to the credit union by a particular member is in service to the greater membership, and so serving that compliance goal by taking those difficult positions, really is important. It’s not double-speak for credit unions to say they’re in business for the service of members while also taking the appropriate compliance and loss mitigation steps. You can actually do both.

Humphrey: One of the hardest jobs of a credit union’s board of directors is balancing out the needs of the institution and balancing out the needs of the members. Making sure that everyone is getting served, but at a certain point you have to pick the best option for the most members.

Newman: And it doesn’t mean you don’t care about a member by taking those steps.

Stoltz: We have a core value, which is to be “thoughtfully compassionate.” But that can bring some challenges when you’re overly thoughtfully compassionate. It’s always balancing that heart, that compassion with business acumen. I do feel it’s part of all credit unions’ missions to help as many people as possible but doing it responsibly so that the credit union is protected.

Koening: Dan, what’s one thing you’re genuinely excited about as we head into 2026?

Stoltz: What color is between a yellow and green light? I don’t know that it’s going to be full on green, but I do have an optimistic view towards next year. There will be more “knowns” one year into Donald Trump’s presidency and I believe interest rates are going to be coming down, so the consumer and businesses are going to see some activation. Once again, I don’t know that credit unions will be full on green, but I do see us moving forward in a stronger way.

Riechers: When you’re seeing higher tenant vacancy and elevated cap rates, it’s no surprise that property values are trending below where they were five to seven years ago when many of those business loans were originated. That shift actually puts credit unions in a strong position. We’ve already been proactive by working closely with our business members over the last couple of years, and heading into next year, I see real opportunity to further support the commercial real estate space.

On the consumer side, I expect rates to decline, which should help open up the housing market. Now that some time has passed since the transition in federal leadership, we’ll likely see less frequent change and more stability – giving us a clearer view of what’s ahead.

Koening: Mara, what gives you the most optimism about the future of credit unions?

Humphrey: Credit unions in Minnesota continue to grow, continue to build new branches, continue to serve new locations and continue to attract new members. We’re continuing to see the interest in community-based financial institutions who are locally based and giving back to their community. We’re also continuing to see the strategy of both the technology attracting new members, as well as the brick-and-mortar and consumers learning the type of customer service that credit unions provide. As we look ahead to the future, we just had two new credit unions open up here in Minnesota, so as we’re talking about industry consolidation as a whole, we just had two new openings and we’re working with a third one. I think it really shows the continued relevance and interest in the credit union model.

Stoltz: One thing I wanted to add is that the credit union industry has more liquidity and cash on the sidelines to make loans than we have had in a very long time. So, if there’s a need or the economy takes off, we are positioned with plenty of liquidity and cash on hand to make loans.

Koening: Dan, what about a concern you’re keeping an eye on as we approach 2026?

Stoltz: One that could be a red light is how leveraged the consumer is. After 2020, everybody wanted to go on trips, buy things, and have experiences. Consumers spent a significant amount of their savings after the pandemic, because everybody was restricted for so long. So, the question is, while we offer Visa cards, mortgages, and auto loans, but how extended is that consumer? Even if we turn the notch up in the economy as the consumer feels good enough to spend, they might already be overextended. We’re seeing delinquencies bump up a little bit, so people are missing more payments. The real question is, will consumers continue to be over extended, or will the economy eventually turn to the better and allow consumers to bring their finances into better alignment?

Riechers: Another issue I would highlight is cybersecurity. While AI brings a lot of benefit, it also gives fraudsters and bad actors more sophisticated tools—making them harder to detect and more deceptive than ever. More than 500 new types of malware are being introduced every single day. Even keeping up with routine software updates can become a challenge as organizations try to stay ahead of these evolving threats.

Koening: How can credit unions work together more effectively during times of uncertainty?

Humphrey: Specifically about fraud, we’ve had several efforts of collaboration around helping support each other fight fraud and helping educate consumers. We have a fraud task force, so credit unions around the state meet quarterly and talk about what they’re seeing and sharing resources. Typically, fraudsters go from one institution to another, so helping support each other is really important. Also, we’ve had a couple of fraudfighter groups partner with credit unions to educate the community. For example, credit unions over in Brainerd have been doing segments and organizations have gone to senior centers to educate the communities there about fraud.

Riechers: We have multiple networks operating behind the scenes that are constantly sharing information and collaborating on new tactics. The goal is that if one person encounters fraud, we all learn from it – rather than repeating the same situation over and over.

Newman: Those fraud situations also come in as a matter of trend. They tend to migrate from the coasts into the middle. So, if your colleagues out in places like New York or San Francisco would be so kind as to wave their red lights at you, that would be helpful.

Koening: Is there anything more we can do to prevent fraud collaboratively?

Humphrey: I think education is key. It’s not just financial institutions that are facing fraud, so I think it’s important for the broader business community to talk to members and customers about fraud and making sure that people know not to click on every email and respond. Question it and use a second source of verification. I do think there could be a broader business community effort to really help combat fraud. We’d love to see law enforcement agencies have more resources to partner with financial institutions to target and prosecute fraudsters on a larger scale.

Koening: Brandon, how are you building meaningful partnerships with local organizations and businesses?

Riechers: It’s an ongoing support system – being that trusted advisor for consumers and businesses to turn to when they have questions. That’s one of the key reasons why being a strong community partner and advocate matters. You want people to feel comfortable reaching out when something doesn’t seem right in a transaction or within their financial life.

Stoltz: Also, credit unions are stepping up and working together on the new financial literacy mandate in schools. A lot of credit unions want to be part of the solution, put money toward financial literacy programs and be a partner because schools are being stretched in so many different ways with budgets.

Humphrey: Yeah, it’s been really fun to see credit unions jumping in to support as these mandates go in. Not every social studies teacher is going to know how to teach financial education, but credit unions offering themselves as resources and support systems is really exciting because it is a really critical skill for high schoolers to learn.

Koening: Patrick, let’s explore some of the challenges you raised. How are your institutions preparing for litigation trends like pro se filings, sovereign citizen claims and class actions?

Newman: If you don’t have your compliance scaffolding in place, maybe now is time to be doing that. What I can tell you is that I fully expect that 2026 will continue an upward trajectory in litigation in consumer finance, including the credit union industry as a whole. That said, I truly am optimistic about this industry because it is quite resilient and really does fare well in these difficult regulatory and financial times because of who they are at their core. I’m very optimistic about the industry’s readiness to rise to that occasion. But, the best way to litigate a case is to not have it. An ounce of prevention is worth a pound of cure, if you like. In the same vein, things have changed over the years about who your compliance people should be, what their training level is and where your expectations of their responsibilities should be. I think they need to be a combination of your best customer service representatives and critical thinkers. I have found that people who come from the customer care side into the compliance side do very well because they know how to diffuse, de-escalate and problem solve. So, take those people and reward them within your organizations and get them into your compliance processes when possible.

Koening: How do you ensure frontline teams are trained to spot and escalate issues early?

Newman: The greatest antidote to a lot of these problems is having the folks who, on the phone or at the front desk, can hear when a member is not happy. I think the greatest utility player on your team is the one who understands the compliance requirements and is also capable of getting on the horn and de-escalating or being a second voice. What I’m really describing to you is your quintessential compliance manager.

Riechers: We often say it’s important to focus on doing what’s right—not being right. That helps team members understand our approach.

Koening: Brandon, how are you using AI to enhance member experiences while maintaining trust and transparency?

Riechers: Having a full 360-degree view of the member builds trust—it allows us to deliver personalized service, meet their needs, and seamlessly follow through. We use AI extensively in fraud detection to protect both our members’ assets and our own. AI also drives efficiency. Every day, we’re doing more with AI that brings value back to the cooperative—delivering faster, more cost-effective service.

Stoltz: I also don’t see AI taking over. A lot of people are concerned about AI replacing jobs and things like that, but it’s just going to create more ways we have to do our jobs and give us more thoroughness in what we do. So, I look at AI as a real positive investment.

Koening: Patrick, how do you navigate the intersection of compliance, litigation avoidance and maintaining member trust — especially when legal outcomes may conflict with a member’s perception of fairness?

Newman: You need a process that is followed, but with enough leeway that you can do right by members under the circumstances. And then be prepared to follow through with the processes as it’s designed. Go ahead and use the processes in the way they were designed and do away with the notion that that’s somehow untoward to the member. If I were designing a 2026 goal from a compliance standpoint, that’s what it would be, which is to have those in place and then use them the way they’re designed.

Koening: Dan, you’ve been watching workplace trends closely. With employees returning to the office, how is that shaping your culture?

Stoltz: Every CEO says culture is more important than strategy. It starts with culture, as that sets the tone of who we are and how we live out our values. There isn’t a right or wrong answer to this question, because you have to understand your culture and what you want, but there is a tendency now to having employees work at the office versus at home. At Blaze, half of our staff, our retail staff, are in every day. But then I’ve got an administration that has some flexibility in their work. We’ve gone from two to three days in the office, and those two hybrid days cannot be Mondays or Fridays, since those are when we are busiest. But, we are also looking to possibly push that to four or five days in the office to keep some congruency and really focus on that culture. That’s what’s best for Blaze, but there are some credit unions where virtual/remote works great.

Riechers: We also are coming in to the office more. We have a lot of hybrid employees, but similar to you, half the staff is retail, so they are fully in the office. For those that are hybrid, it’s about being more intentional when they come in so there’s still that camaraderie and engagement when the whole department is in the office.

Stoltz: I’m just passionate about the energy that’s in a building when everybody’s there and you get to know people. When everyone is in the office, the camaraderie feels much stronger.

Riechers: You’ve got a team that fully understands every role is centered around supporting the member experience. That shared purpose drives growth and development across the organization—and while being in person can enhance that connection, it’s just as important to foster it across hybrid and remote settings.

Stoltz: It also helps for mentoring the younger employees. I think about my career and the people who invested in me. In the offices, I could just pick their brain and learn from them. When you get those kinds of people that you can kind of bounce ideas off of and learn from, that’s invaluable.

Koening: As we wrap up tonight’s discussion, I’d like to invite each of you to share one final thought. What’s one idea or insight from tonight that you’ll take back to your team tomorrow?

Riechers: We talked a lot about volatility and yellow lights. In an industry where so many are focused on disruption, we have an opportunity to lean into connection instead—and strengthen relationships and trust.

Newman: I am actually very optimistic about what the last quarter here is going to look like and what 2026 will look like. It is refreshing to have clientele that are putting good faith into what they’re doing on a day-to-day basis, which makes things easier. That’s credit unions in a nutshell.

Stoltz: This is our time. We can be that force. We double down in recessions during tough times because this is when we can talk about the credit union difference. People are looking for a voice and a support system in these uncertain times, and our style of banking really fits well right now.

Humphrey: I’m leaving excited about the future of the credit union industry here in Minnesota. We have strong leaders, strong teams and are really focused on being the trusted financial services provider here in Minnesota. Continuing to invest in our communities, continuing to invest in infrastructure, continuing to help support individuals and their journeys, so encourage anyone who’s not a credit union member to check one out and see what they can offer you.