Advertisement

Source: site

The announcement sent TransUnion’s stock up 3.9%, shaking up what had been an uninspiring run. Over the past year, the company has seen shares drift lower by about 7%, but recent weeks suggest momentum may be shifting, with gains of nearly 4% over the past month and quarter. That improvement coincides with renewed optimism around the business as investors consider not only this partnership news but also new solution launches and ongoing expansion efforts.

Given this upward movement and recent growth signals, is TransUnion now trading below its true value, or is the market already factoring in a brighter future ahead? Let’s dig into the numbers.

Most Popular Narrative: 20.7% Undervalued

The current consensus views TransUnion as significantly undervalued, based on forward-looking assumptions around revenue, profit margin, and earnings momentum.

Long-term demand for consumer credit data and risk analytics is being fueled by the digitization of financial services and expansion of the middle class in emerging markets. Management has highlighted accelerating growth and a large market share in India, which is poised for over 20% annual growth, as well as continued momentum in markets like Africa, Canada, and Latin America. This is likely to support robust organic revenue growth over multiple years.

Curious about the secret behind this aggressive price target? The story hinges on high-octane projections and ambitious profitability benchmarks that rival much larger tech players. Want to unlock the assumptions that could rewrite TransUnion’s valuation playbook? Discover what is powering these bold estimates in the full narrative.

Result: Fair Value of $113.15 (UNDERVALUED)

Have a read of the narrative in full and understand what’s behind the forecasts.

However, intensified regulatory scrutiny or a high-profile data breach could quickly challenge these upbeat projections and reduce investor enthusiasm for TransUnion.

Find out about the key risks to this TransUnion narrative.

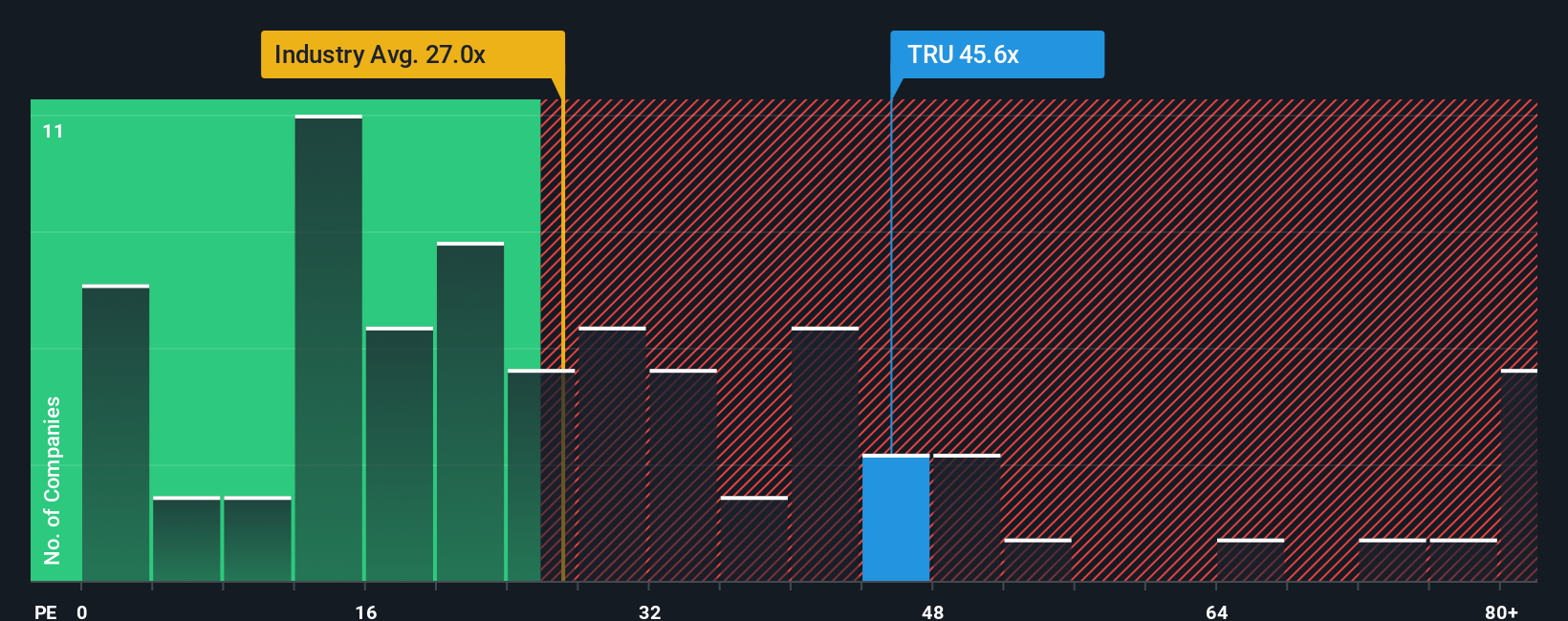

Another View: Multiples Tell a Different Story

Looking at TransUnion’s valuation from another perspective, the company’s current market price appears expensive compared to the industry average for similar companies. Could the market be too optimistic about future growth, or is something missing from the picture?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding TransUnion to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own TransUnion Narrative

If you have your own take on TransUnion’s future or would rather analyze the numbers firsthand, you can develop your own narrative in just a few minutes. Do it your way

A great starting point for your TransUnion research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Level up your portfolio by going beyond the obvious. Don’t let the next breakout opportunity pass you by. Let these innovative stock searches guide your next smart move.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if TransUnion might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com