According to the U.S. Bank Freight Payment Index, national truck shipments in Q4 2025 inched up 1.5% quarter over quarter but remained 4.9% below year‑earlier levels, marking the fifteenth consecutive quarter of year‑over‑year volume decline. Shipper spending, however, rose 4.6% quarter over quarter and 5.2% year over year, reaching its highest level since early 2024 as reduced fleet capacity pushed rates higher despite soft volumes. Across 2025, freight volumes fell 9.9% versus 2024, a smaller drop than the steep 20.4% annual decline in 2024, signaling that demand deterioration is moderating but has not reversed.

“It’s clear there are both cyclical and structural challenges remaining as we look for a truck freight market reboot,” said Bob Costello, senior vice president and chief economist at the American Trucking Associations. “For instance, factory output softness – which has a disproportionate impact on truck freight volumes – is currently weighing heavily on our industry.”

Capacity and Pricing Dynamics

Industry capacity continues to contract through carrier exits and headcount reductions, tightening the supply of available trucks even as freight demand remains subdued. This adjustment is allowing carriers to regain pricing power: shippers are paying materially more to move only slightly more freight, indicating higher per‑unit transport costs embedded in supply chains. These conditions point to a freight market that is moving off the bottom but remains fragile, with pricing supported more by supply discipline than robust end‑market growth.

Regional Patterns and Sector Sensitivities

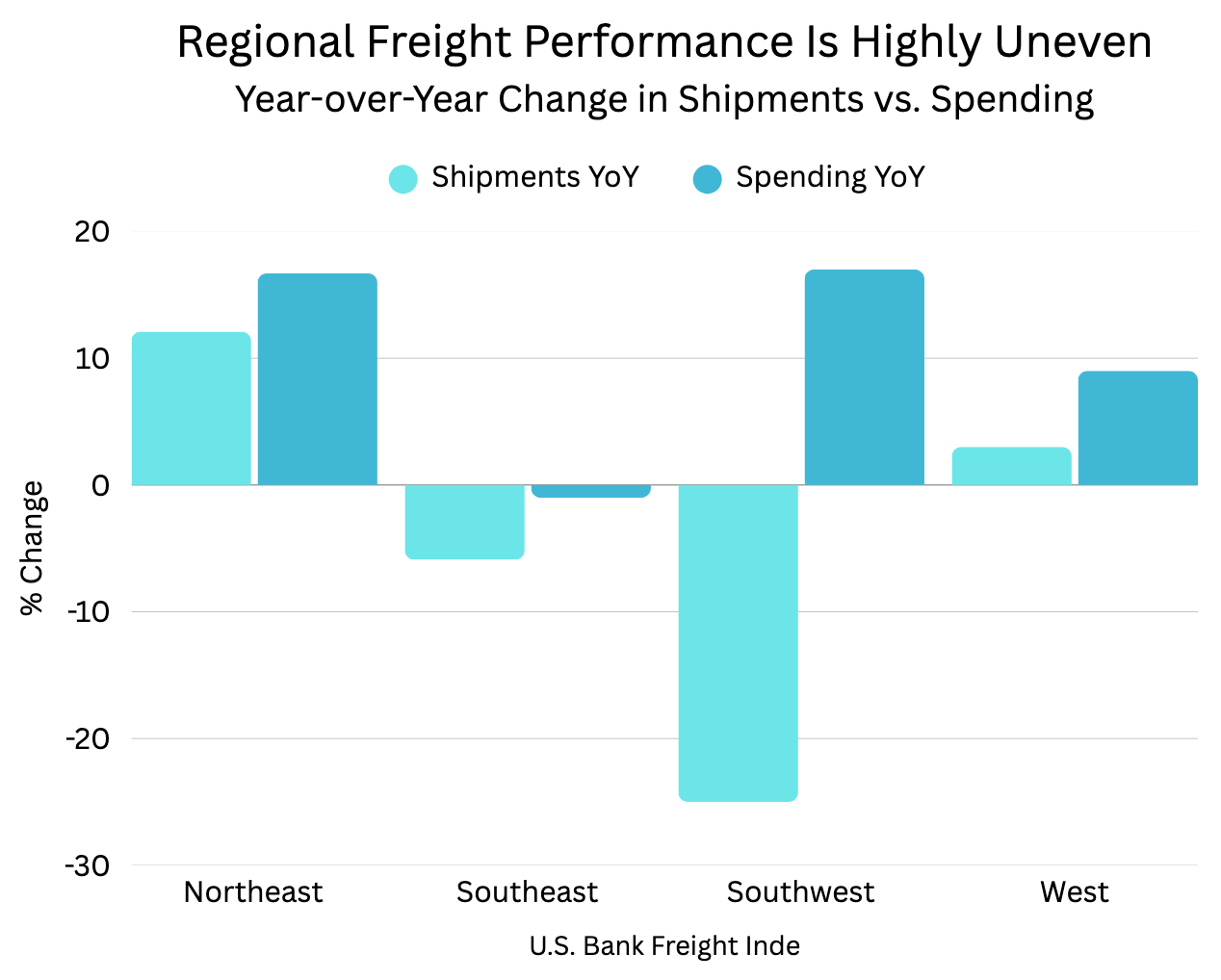

Regional results are highly uneven and matter for exposure analysis. The Northeast posted the strongest momentum, with shipments up 4.2% quarter over quarter and 12.1% year over year, and spending up 5.5% and 16.7% respectively, signaling both volume growth and rate pressure. The Southwest showed a sharp disconnect: shipments fell 25.4% year over year while spending jumped 16.8%, reflecting acute capacity constraints and elevated transport costs despite weaker freight activity. The West delivered modest quarterly shipment decline but positive year‑over‑year gains, with 2025 volumes up 3.2% over 2024 and spending up 9.4% year over year, underscoring a relatively healthier freight environment. The Southeast contracted in shipments (‑2.4% quarter over quarter, ‑5.9% year over year), with only marginal spending growth and slight annual decline, consistent with pressure from cautious consumers and federal fiscal disruptions.

Implications for Trade Creditors

For trade credit teams, this environment combines margin pressure for shippers with gradually improving but uneven conditions for carriers. Shippers face rising transportation costs per unit just as end‑market demand in manufacturing, construction, and consumer sectors remains under strain, heightening the risk of working‑capital stress and delayed payables to logistics and input suppliers.

Carrier credit profiles may bifurcate: large, well‑capitalized fleets can benefit from tightening capacity and stronger pricing, while smaller or highly leveraged carriers remain vulnerable after a prolonged downturn. Credit underwriting should therefore emphasize lane mix and regional exposure (for example, Southwest capacity tightness versus Northeast growth) as well as customer concentration in freight‑sensitive sectors.

Liquidity planning should factor in the possibility of longer receivable cycles in freight‑exposed industries and the need for flexible short‑term funding to bridge inventory and transport outlays. The Index data reinforces the value of monitoring freight trends as a leading indicator for portfolio risk.