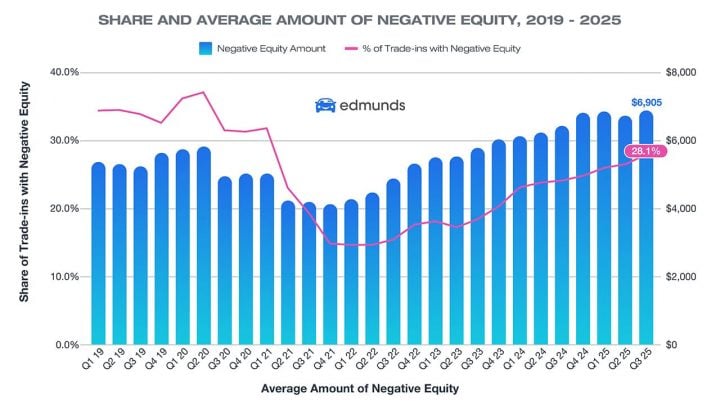

Newly published data from Edmunds shows that upside-down car loan debt hit an all-time high in the third quarter of 2025. 28.1 percent of cars traded in during Q3 2025 were worth less than what the owner owed on them, and the average amount of negative equity was $6,905.

Although the average amount owed on the cars traded in is at an all-time high, the percentage of underwater cars traded in was not. 2019 and 2020 saw higher percentages of underwater cars traded in, but the average negative equity was under $6,000. Negative equity trade-ins tanked in the post-pandemic supply chain crisis when used car values skyrocketed, but they’ve been steadily creeping up since early 2022.

Another concerning statistic in the newly released data shows that 24.7 percent of cars traded in with negative equity were underwater by more than $10,000. That means almost one in four shoppers who trade in a car with negative equity owe an extra $10,000 or more on top of the amount financed for their new car loan.

“The sheer amount of debt consumers are carrying in their trade-ins should be a wake-up call,” said Ivan Drury, Edmunds’ director of insights. “Nearly one in three upside-down car owners owe between $5,000 and $10,000 — and a growing share owe far more than that. Much of this stems from shoppers trading out of vehicles too quickly, or carrying loans taken out during the pandemic car market frenzy, when prices were at record highs. Those choices are now catching up, making it far harder to buy again without piling on even more debt.”

“For many car owners, there’s no quick fix for being underwater. It’s about minimizing how much deeper you go,” said Joseph Yoon, Edmunds’ consumer insights analyst. “If you can, wait until you’ve paid down more of your balance before trading in. But if you do need to replace your car, make sure your next purchase fits your budget, not just your needs. The right vehicle choice can prevent a short-term decision from becoming a long-term setback.”